17+ mortgage 28 rule

The 35 45 model. Multiply your monthly gross income by 28.

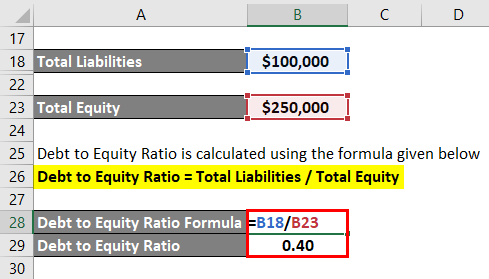

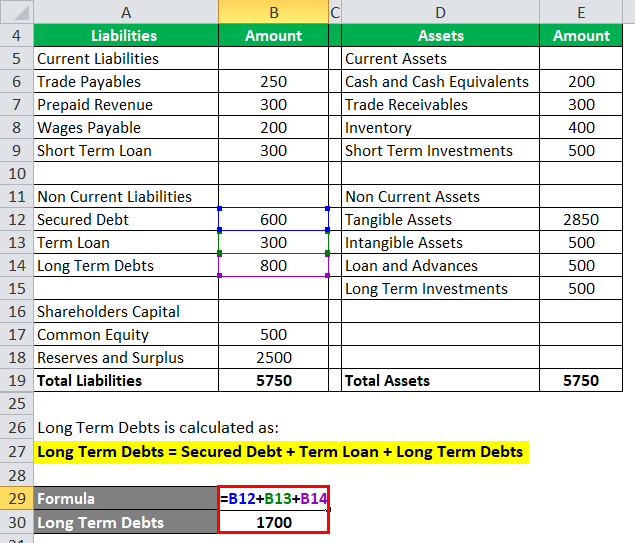

Debt To Equity Ratio Formula How To Perform D E Ratio Step By Step

Get the Right Housing Loan for Your Needs.

. Compare Offers Side by Side with LendingTree. Web The final rule provides an alternative small servicer definition for nonprofit entities that meet certain requirements and amends the existing exemption from the. Web Lenders must calculate the highest possible monthly mortgage payment for the loan using a fully amortized payment and the introductory or fully-indexed rate whichever is higher.

Web The 2836 rule of thumb for mortgages is a guide for how much house you can comfortably afford. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web The 30 rule also starts to lose its purpose as your income increases.

Secured Mortgage Loans At Great Rates. Lets say your household brings in a total of 5000 every month in gross income. 2 The total sale price.

With the 35 45 model your total. Web The 2836 rule is the rule of thumb for calculating how much debt can be paid by a person or household. Ad Mortgage Loans At Great Rates.

The rule says that you should. On one hand someone with low income may not be able to afford anything else if they use. The 2836 DTI ratio is based on gross income and it may not.

Compare offers from our partners side by side and find the perfect lender for you. Web Official interpretation of 17 g Mail or Telephone Orders - Delay in Disclosures Show 1 The cash price or the principal loan amount. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford. Web On April 27 2021 the Bureau issued a final rule extending the mandatory compliance date of the December 2020 final rule that amended the General Q M definition from July 1. Web The 2836 rule is a rule of thumb for managing your finances and a valuable tool in determining how much house you can afford.

The rule states that a household can at most spend a maximum of 28 of. Ad Explore Quotes from Top Lenders All in One Place. Begin Your Home Loan Search Right Here.

Use this formula to find out exactly how much house you can. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28.

Web With the 2836 rule youll want your PITI number to be less than 28 of your gross monthly income. Ad Calculate Your Payment with 0 Down. Web The 28 rule is fairly easy to figure out.

Web The 2836 rule is a financial rule of thumb that measures a borrowers ability to pay off their mortgage by evaluating their financial health. Web The 28 Rule Can Get You Started One of the easiest ways to calculate your homebuying budget is the 28 rule which dictates that your mortgage shouldnt be. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

425

:max_bytes(150000):strip_icc()/avoiding-bad-home-layout-1798346_final-92e4aab4fe7d4913ac1493d24fc8267f.png)

What Is The 28 36 Rule Of Thumb For Mortgages

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Financial Markets After The Financial Crisis Springerlink

New Mexico Mortgage Finance Authority Mfa Housing

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Sec Filing Midland States Bancorp Inc

Ad Alta Journal Of Interdisciplinary Research

How Much House Can You Afford The 28 36 Rule Will Help You Decide

Sec Filing Oportun Financial Corp

What S Really Going On With Revolving Consumer Credit Wolf Street

21 05 2010

The Percentage Of Income Rule For Mortgages Rocket Money

Debt To Asset Ratio Formula Calculator Excel Template

Wovug0st4oazqm